Addressing AI - Powered Fraud

Improving the user experience for everyday banking tasks while enhancing security and accessibility.

TOOLS

Figma, Google Docs, Canva

IOS

PLATFORM

TIMELINE

24 Hours

ROLE

UI / UX Designer / Researcher

Project Overview

The Challenge

AI driven fraud is becoming increasingly difficult to detect, as bad actors use sophisticated techniques to deceive users. The challenge was to create a digital solution that could educate users without disrupting their experience. We needed a way to build awareness and trust while maintaining the seamless, premium feel expected from the American Express brand.

Security Measures Disrupt the Experience

Lack of User Engagement

Outdated or Static Content

The Solution

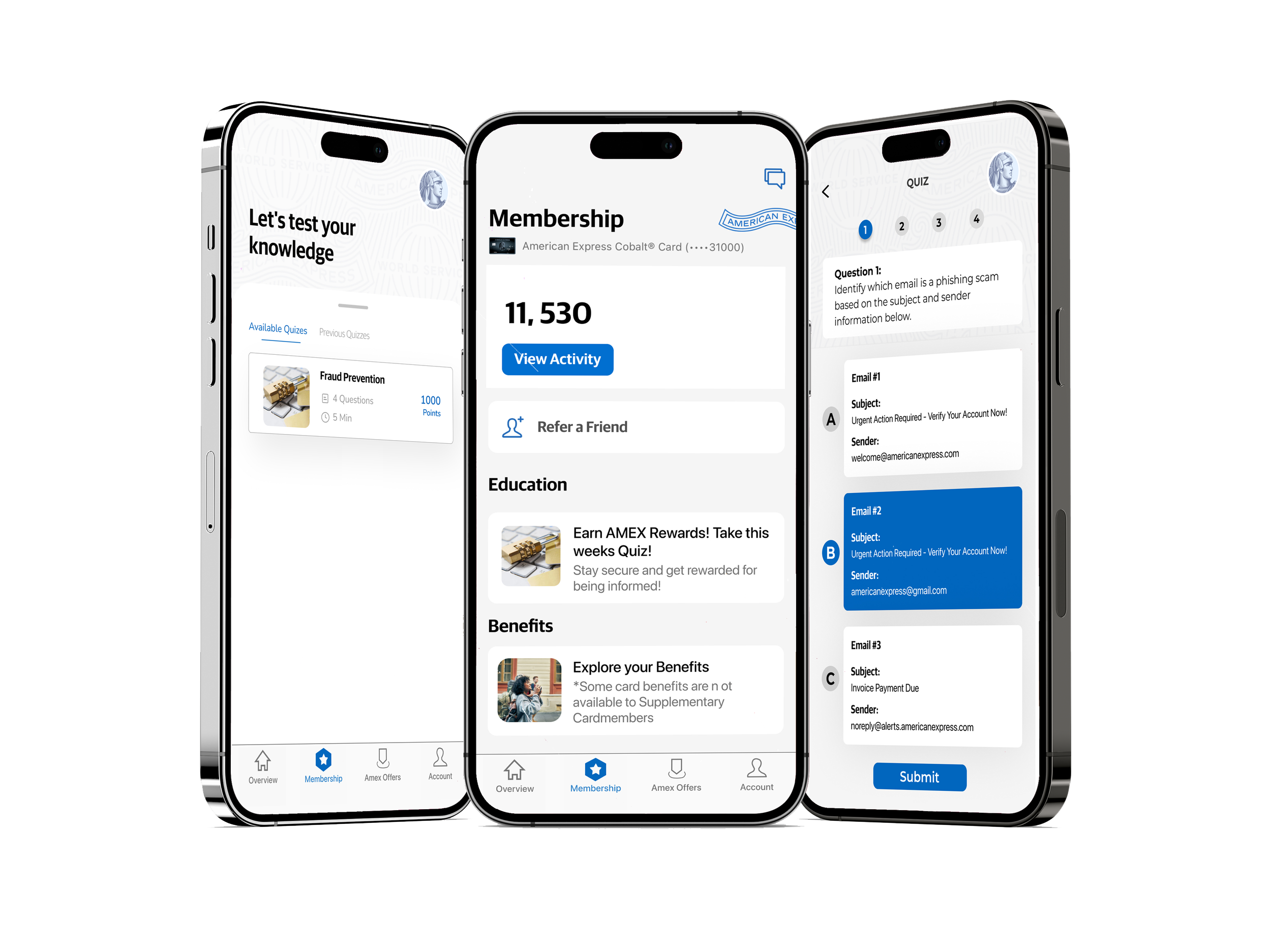

To bridge the gap between security and user experience, we developed a digital quiz that educates users on AI-driven fraud while preserving the seamless experience American Express customers expect. This solution not only raises awareness but also empowers users to confidently identify and avoid potential fraud attempts.

Created an Interactive Quiz

Integrated the Tool Seamlessly

Focused on Behavior Based Learning

The Team

2

UX /UI Designers

Software Engineer

1

2

Data Scientists

2

Cyber Security Analyst

Research & Design Process

Design Challenge

How might we leverage digital tools to prevent fraud that occurs by bad actors leveraging AI to commit fraud, while maintaining a seamless user experience for our banking customers?

Secondary Research

Consumers were defrauded of more than $3.3 billion in 2020

$3.3 BILLION

About 33% of Americans have been affected by identity theft

33%

1 in 20 digital transactions in Canada is suspected fraudulent

1 in 20

User Surveys

Due to time constraints, I chose Google Forms for our user surveys. I determined to dive deep into the minds of our users, uncovering their challenges and preferences when it came to security. This method allowed me to gather essential insights efficiently, ensuring I could truly understand their needs and concerns in a limited timeframe.Findings

Through our user surveys, we discovered that users have varying levels of financial knowledge; some are quite knowledgeable, while others are less so. They generally find their bank's fraud prevention measures robust but believe there is room for improvement, particularly in terms of accessibility and clarity.Users have varying familiarity with financial fraud, with some being highly knowledgeable and others less so.

Preferences for learning include interactive modules, detailed articles, workshops, and clear guidelines.

Persona

Sophia Bennett, The City Sculptor

“I haven’t had any formal education or training on financial fraud, so I often feel unsure about how to recognize or handle potential threats”

SINGLE INCOME

CIVIL ENGINEER

35 YEARS OLD

BEHAVIOURS:

Seeks reliable information from credible and trusted sources.

Wants ongoing support to stay up-to-date with the latest fraud tactics.

GOALS:

Looking for an easy-to-understand way to stay informed about fraud prevention.

Wants a quick, accessible resource to build confidence in spotting scams.

Aims to feel empowered and in control when managing potential fraud threats.

PAIN POINTS:

Frustrated by the constant interruption from suspicious emails, calls, and texts.

Feels overwhelmed and unsure how to tell what’s real and what’s a scam.

Worries about accidentally falling for a phishing attempt and compromising personal information.

PERSONALITY

INSIGHTFUL

HARDWORKING

SUMMARY:

From the user interviews and stories, we developed a persona that encapsulates the users' pain points, motivations, and behaviors.Meet Sophia Bennet, a 35-year-old civil engineer who frequently uses online banking. She finds herself stressed by persistent phishing emails, calls, and texts. Without formal training in financial fraud, Sophia often feels uncertain about identifying and handling potential threats. She desires a seamless digital banking experience with integrated fraud prevention tools that do not disrupt her daily routine.MOST USED DEVICES:

Digital Solution

PROTOTYPE

Finalizing the Prototype

HI - FI PROTOTYPE

During the hackathon, we tackled the challenge of AI-driven fraud by creating an innovative solution that directly targets the increasingly deceptive tactics used by fraudsters. Our team designed an engaging quiz that educates users on detecting fraudulent activities, all while staying true to the American Express brand. This interactive tool not only raises awareness but also equips individuals with the knowledge needed to identify and counter these sophisticated fraud attempts.

Results

Regular check-ins with each discipline are essential to stay updated and ensure everyone is on the same page. By leveraging our strengths at the project's outset, we effectively divided tasks according to our skills, maximizing both efficiency and quality in our work. Additionally, setting time limits significantly contributed to achieving the project's goals.Key Learnings

Communication: Clear and frequent communication is crucial for our team's success.Contributions/Strengths: Help create a collaborated environment.Time Management: Prioritize task and setting time limits contributes to the projects goal.

For future work, we plan to develop additional screens for the quiz to enhance its functionality and user engagement further. This will involve creating more diverse and interactive content to keep users engaged and provide a richer experience. Additionally, we will conduct extensive usability testing to gather feedback and identify any areas for improvement. By iterating on our designs based on real user insights, we aim to refine and optimize the quiz to ensure it meets the highest standards of usability and accessibility. This continuous improvement process will help us create a more intuitive and enjoyable user experience.Next Steps

Develop additional screens for the quiz

Usability testing